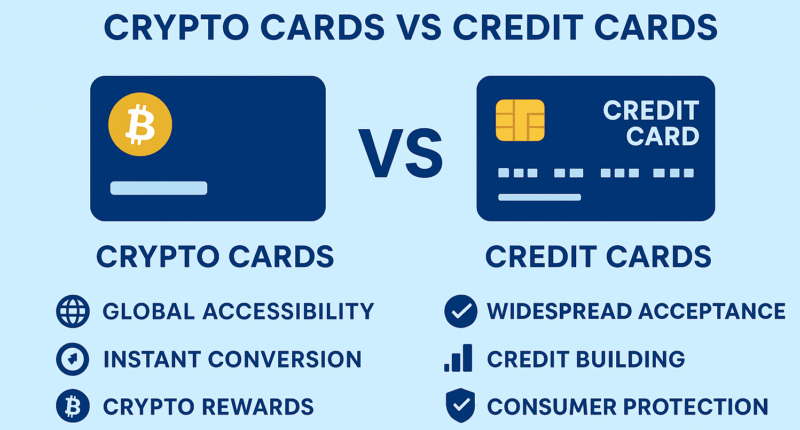

The payment industry is evolving rapidly, and two major players are shaping its future: crypto cards and traditional credit cards. As digital assets gain wider acceptance, consumers now have more ways to spend their money — whether through blockchain-powered transactions or the familiar swipe of a plastic card. But which option will dominate the future of payments? Let’s explore the differences, benefits, and challenges of crypto cards versus credit cards.

Understanding Crypto Cards and Credit Cards

What Are Crypto Cards?

Crypto cards are payment cards linked to a cryptocurrency wallet or exchange account. They allow users to spend their crypto holdings like regular money, usually converting crypto into fiat currency (like USD) at the time of purchase. Popular examples include the Binance Card, Coinbase Card, and Crypto.com Visa Card.

What Are Credit Cards?

Credit cards are traditional financial tools issued by banks or credit institutions. They allow users to borrow funds up to a certain limit and pay them back later, often with interest if not paid in full. Credit cards have been the cornerstone of cashless payments for decades.

Advantages of Crypto Cards

1. Global Accessibility

Crypto cards allow users to spend anywhere that accepts Visa or Mastercard, making them a global solution for crypto enthusiasts.

2. Instant Conversion

Most crypto cards instantly convert your digital assets into fiat currency at the point of sale, so merchants do not need to accept crypto directly.

3. Crypto Rewards

Some crypto cards offer rewards in the form of cryptocurrency instead of cashback or points, helping users accumulate more digital assets over time.

Advantages of Credit Cards

1. Widespread Acceptance

Credit cards are accepted virtually everywhere, making them one of the most convenient payment methods in the world.

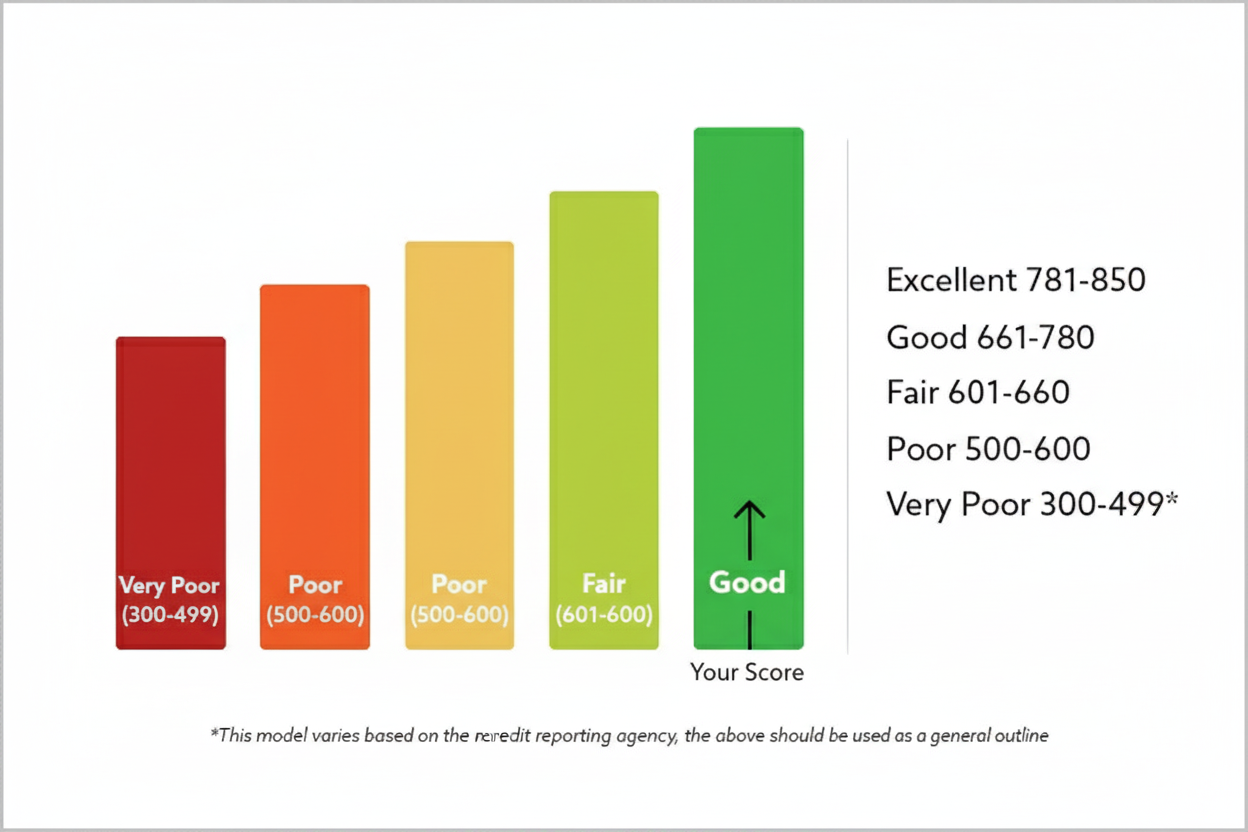

2. Credit Building

Responsible use of credit cards can help build a positive credit history, which is essential for getting loans or mortgages in the future.

3. Consumer Protection

Credit cards come with fraud protection, chargeback options, and purchase insurance, giving users peace of mind when shopping.

Challenges of Crypto Cards

While crypto cards are innovative, they face challenges like price volatility, which can impact the value of your purchase. Additionally, not all regions support crypto card issuance, and there may be fees for conversion or withdrawals.

The Future of Payments

The future is likely to be a hybrid payment ecosystem. Crypto cards are ideal for those who hold and believe in digital assets, while credit cards will continue to serve consumers who prefer stable, fiat-based transactions. Over time, as blockchain adoption grows and regulations become clearer, crypto cards may play a larger role in everyday payments, competing directly with credit cards for consumer preference.

Conclusion

The battle between crypto cards vs credit cards is not about replacing one with the other but about offering consumers more choices. Whether you prefer the flexibility of credit or the innovation of crypto, the future of payments will combine the best of both worlds — secure, fast, and globally accessible transactions.

2 comments

Still credit cards are preferable

Good